The Spanish housing market continues its upward trajectory, with notable price increases across major cities. The first quarter of the year saw an average national price rise of 7.5%, with some urban centers experiencing even sharper increases. This growth is driven by strong demand, limited supply, and investor interest. Below, we analyze the key regional trends shaping the market. Keep reading for an update on Spain’s housing market surges: regional price trends and key insights.

Madrid: Reaching Historic Highs with a 15% Surge

Madrid remains one of Spain’s most dynamic real estate markets, with housing prices rising 15.1% year-over-year, surpassing the 4,000 euros/m² threshold. The current average price of 4,285 euros/m² is 6.1% higher than the 2008 pre-crisis peak.

Districts with the Highest Price Growth:

- Ciudad Lineal (+13.6%) – 3,733 euros/m²

- Usera (+13.2%)

- Moncloa-Aravaca (+12.4%)

- Moratalaz (+11.7%)

- Salamanca (+11.2%) – 6,615 euros/m² (highest in Madrid)

Despite the strong demand, affordable housing remains scarce, with the lowest prices in Villaverde (2,236 euros/m²) and Puente de Vallecas (2,293 euros/m²).

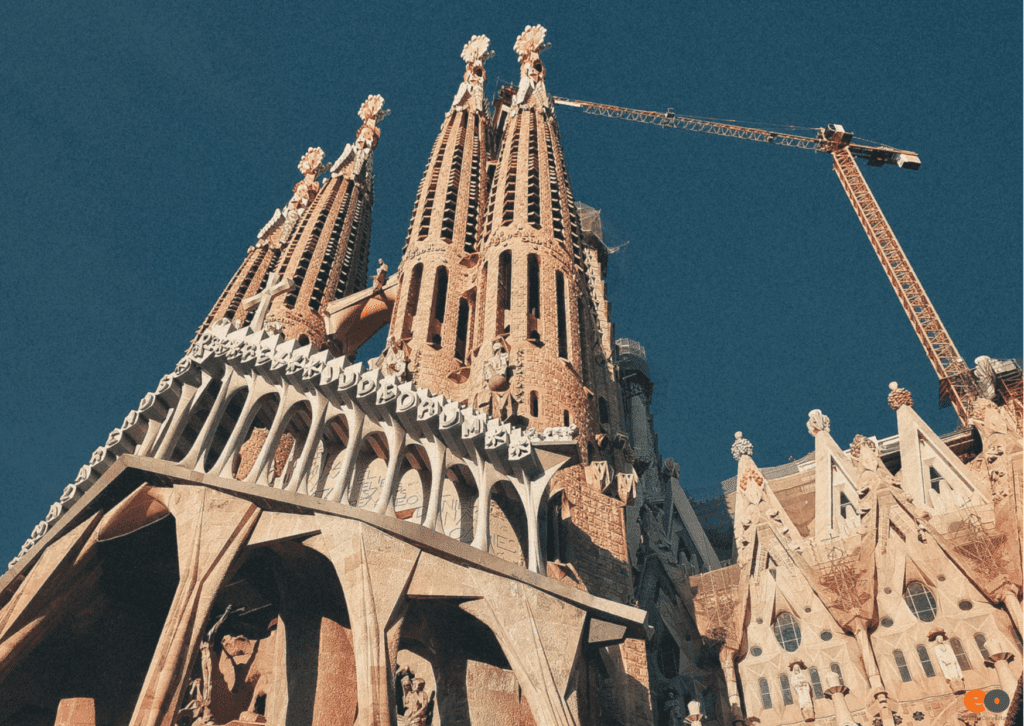

Barcelona: 8% Growth Amidst Rising Regulatory Pressures

Barcelona’s property prices increased 8% to 3,998 euros/m², with the city approaching the 4,000 euro mark. However, market expansion faces hurdles due to regulatory uncertainty, limited land availability, and high transaction taxes.

Top Growth Districts:

- Sant Martí (+7.9%) – 22@ tech district

- Eixample (+7.3%) – 4,607 euros/m²

- Sant Andreu (+6.7%)

- Ciutat Vella (+2.4%)

Sarrià-Sant Gervasi remains Barcelona’s most expensive district at 5,278 euros/m², while Nou Barris is the most affordable at 2,644 euros/m².

Valencia: Prices Rise 10.3%, Surpassing 2,500 euros/m²

Valencia continues its strong growth trajectory, with prices up 10.3% to an average of 2,514 euros/m². Demand from foreign investors, short-term rentals, and limited new developments are driving prices higher.

Fastest Growing Districts:

- L’Eixample (+12.6%) – 3,342 euros/m²

- Ciutat Vella (+11.9%) – 3,166 euros/m²

- Camins al Grau (+11.4%) – 2,597 euros/m²

While more affordable than Madrid or Barcelona, many locals are moving to suburban areas like Mislata, Burjassot, and Torrent due to rising costs.

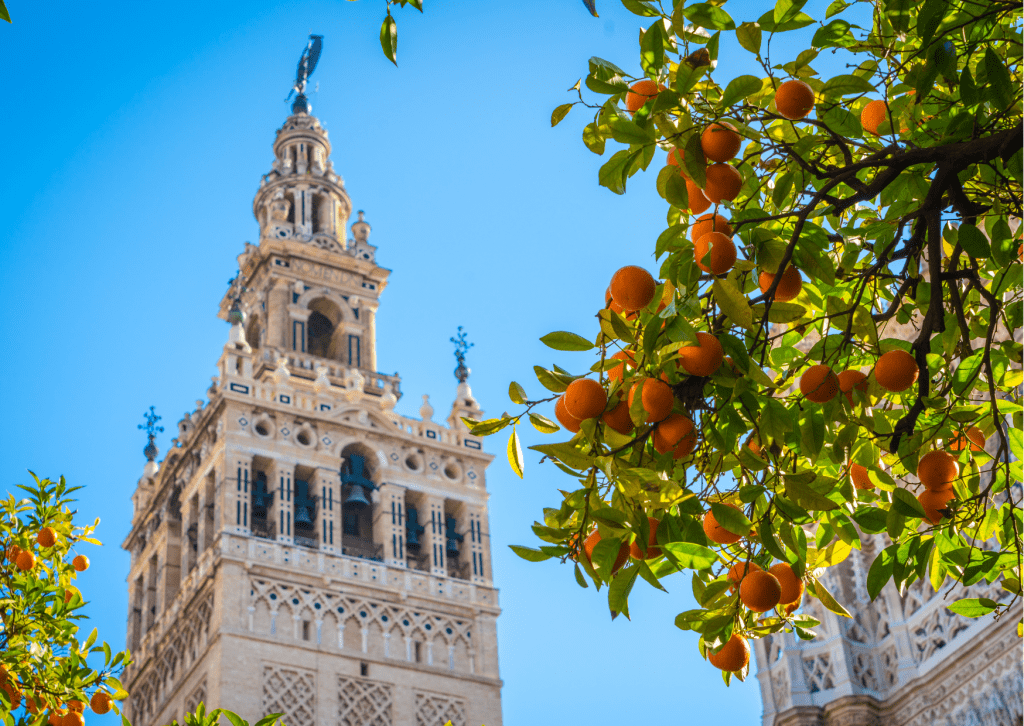

Sevilla: 8.9% Growth Driven by Limited Supply

Sevilla saw a price increase of 8.9%, reaching 2,142 euros/m². With strong rental demand and limited new housing developments, prices are rising across key districts.

Notable Increases:

- Casco Antiguo (+10.7%) – 3,215 euros/m²

- Los Remedios (+9.8%) – 2,955 euros/m²

- Nervión (+9.2%) – 2,784 euros/m²

Despite rising costs, Sevilla remains more affordable than Spain’s largest cities, making it attractive for both buyers and investors.

Bilbao: 7.5% Growth Fueled by Premium Housing Demand

Bilbao’s housing prices rose 7.5% to an average of 3,245 euros/m². The city’s limited space for expansion and high demand for modern housing continue to drive prices upward.

Leading Districts:

- Abando (+9.3%) – 4,312 euros/m²

- Indautxu (+8.7%) – 3,885 euros/m²

- Deusto (+7.8%) – 3,215 euros/m²

Bilbao’s rental market is thriving, but limited new housing developments could impact affordability in the coming years.

Zaragoza: La Almozara Leads a 5.8% Increase

While Zaragoza’s 5.8% price rise is below the national average, its affordability and available land help ease market pressures. Prices now stand at 1,833 euros/m².

Top Growth Areas:

- La Almozara (+9.2%) – 1,748 euros/m²

- Universidad (+7.3%) – 2,064 euros/m²

- Oliver-Valdefierro (+7.2%)

Universidad now matches Centro’s price level for the first time, reflecting its growing appeal for rental investors.

Conclusion: Market Trends and Outlook

Spain’s housing market continues to experience significant price growth, with Madrid, Valencia, and Sevilla leading the increases. While demand remains high, factors such as limited housing supply, investor activity, and rental market expansion are driving prices up across key cities.

However, challenges persist:

- Regulatory uncertainty in Barcelona

- Housing shortages in Bilbao and Sevilla

- Affordability Concerns in Madrid

Experts predict that prices will continue rising in the short term, but long-term affordability and supply constraints may reshape the market dynamics in the years ahead.

Stay tuned for more information on The Price of Rentals in Spain by visiting our blog and social media.

Want to learn more about the different rental contracts in Spain? Head over to our blog entry here.

Looking for updates and trends on the Spanish Rental Market? Search here.

This article talks about Spain’s Housing Market Surges: Regional Price Trends and Key Insights